…deceitfully avert scrutiny of audit by delaying payment as at when due, loses majority shareholder’s position

*Atlas Oranto Petroleum faces regulatory and financial challenges in Equatorial Guinea, Senegal, and Venezuela affecting key energy projects

*In Equatorial Guinea, ownership changes in a major gas block enabled project advancements under new Chevron management

*Senegal bars indefinitely a longstanding exploration license due to compliance and performance issues, emphasizing stricter adherence to regulations

*In Venezuela, policy changes and U.S latest sanctions lead to uncertainty for Atlas Oranto’s projects

*U.S. Energy Secretary, Chris Wright to visit Venezuela shortly to discuss the future leadership of oil company PDVSA

*BY TEKEMA RAPHAEL/ANTI-GRAFT & BUSINESS STAFF WRITER, PARIS, Naija Standard Newspaper Inc USA

FAMOUSLY celebrated Nigerian billionaire, Chief Executive Officer, CEO, Atlas Oranto Petroleum, Arthur Eze is in hot soup, and under fire, as his once-profiting oil businesses are facing a huge backlash, unpaid debt outside the shores of Nigeria. And this oil magnate is now under the United States federal investigation.

Data sighted by our correspondent showed that Atlas Oranto Petroleum is facing setbacks in key energy jurisdictions, including Equatorial Guinea, Senegal and Venezuela, as governments and operators tighten oversight of strategic projects and licences.

Atlas Petroleum, linked to Nigerian oil magnate Arthur Eze, has lost its stake in a strategically important offshore gas licence in Equatorial Guinea following a dispute with operator Chevron.

Per Africa Intelligence, Atlas previously held a 27% interest in Block I, which includes the Aseng field and is central to Equatorial Guinea’s gas export system.

The stake has now been transferred to state oil company GEPetrol, which already owned 5%, following allegations that Atlas delayed payments linked to licence costs.

Meanwhile, Chevron had spent months trying to disengage from its Nigerian partner, arguing the company failed to meet financial obligations.

Consequently, the ownership change removes a major obstacle to the long-delayed Aseng Gas Monetisation Project, expected to require several billion dollars in investment.

Under the revised structure, GEPetrol’s enlarged stake will be carried by Chevron during development, with costs recoverable from future production, allowing the project to proceed without immediate strain on state finances.

*State Deepens Role in Gas Expansion:

Prior to the latest development, OilPrice.com reported that Equatorial Guinea signed a Heads of Agreement with Chevron to raise GEPetrol’s stake in the Aseng project to 32.55%, up from its previous 5%.

At the time, Atlas Oranto had already been sidelined from the project.

The move reinforced the government’s push to consolidate control over gas development under its Extended Gas Mega Hub strategy.

The agreement was signed in the presence of senior government officials, Chevron executives, and the U.S. ambassador, following negotiations initiated after Equatorial Guinea’s vice president visited Washington in 2025.

*Senegal Revokes Long-Stalled Licence:

Atlas Oranto’s difficulties have also extended to Senegal, where the government revoked the Cayar Offshore Shallow exploration licence held by the company.

Authorities said the privately held oil and gas company failed to provide the required bank guarantees and carried out only limited exploration work since the block was awarded in 2008, despite multiple extensions.

*Venezuela Exposure Adds to Pressure:

Beyond Africa, Atlas Oranto faces mounting uncertainty in Venezuela, where the group had pursued offshore gas opportunities through its subsidiary Veneoranto Petroleum.

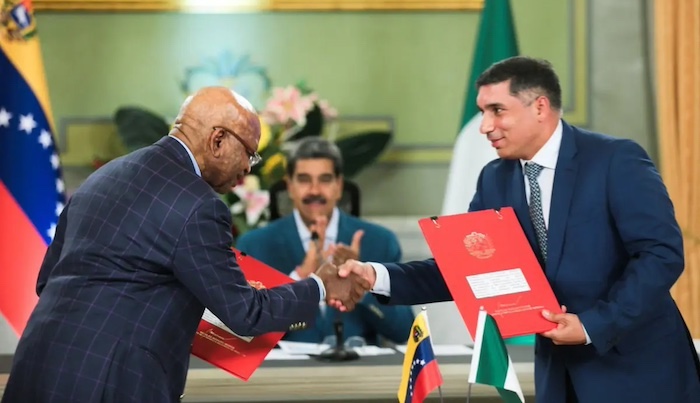

In August 2024, Veneoranto signed agreements with state oil company Petróleos de Venezuela, S.A. (PDVSA) to conduct technical and economic studies for the Barracuda and Boca de Serpiente offshore gas fields, positioning the Nigerian-linked firm within Venezuela’s heavily sanctioned energy sector.

However, the operating environment has shifted following changes in U.S. policy toward Venezuelan oil.

On January 29, 2026, the U.S. Treasury’s Office of Foreign Assets Control issued General License 46, authorising certain transactions involving Venezuelan-origin oil by established U.S. entities under strict conditions.

The new licensing regime, combined with hydrocarbons legislation passed by Venezuela’s interim authorities, is intended to accelerate privatisation of the energy sector and favour Western-aligned investment over contracts signed during the Maduro era.

Agreements linked to the former government, including those involving Atlas Oranto, now face potential renegotiation or cancellation as Washington seeks greater oversight of oil revenues and payment flow.

For the records, U.S. Energy Secretary Chris Wright plans to visit Venezuela soon to “start the dialogue” with officials on the future leadership of Venezuelan oil company PDVSA, Politico reported on Monday.

Wright, who plans to visit some of the nation’s oilfields, told Politico: “PDVSA was a highly professional, technically competent oil and gas company 30 years ago, and it hasn’t been one for quite some time.”

He intended to improve the management of the state-run oil company which has emerged as an obstacle in the Trump administration’s efforts to push international oil companies to invest in the country, the report said.

In December, due to quality issues with the oil and U.S. sanctions, state oil company PDVSA had been forced to slash prices, with the discount to Brent benchmark crude about double year-ago levels.

He planned to meet with acting President Delcy Rodríguez during his time there and expected the country to hold democratic elections in the next 18 to 24 months, Politico said.

DONATE TO HELP BUILD A SPECIAL APPS FOR JOURNALISTS AGAINST LIVER ELEVATION & KIDNEY FAILURE:

CERTAINLY, Good journalism costs a lot of money. Without doubt, only good journalism can ensure the possibility of a good society, an accountable democracy, and a transparent government. We are ready to hold every corrupt government accountable to the citizens. To continually enjoy free access to the best investigative journalism in Nigeria, we are requesting of you to consider making a modest support to this noble endeavor.”

By contributing to NAIJA STANDARD NEWSPAPER, you are helping to sustain a journalism of relevance and ensuring it remains free and available to all without fear or favor.

Your donation is voluntary — please decide how much and how often you want to give.

FOR OFFLINE OR ANONYMOUS DONATION ON THIS PROJECT OR HELP COVER COST FOR SERIES OF UNDERCOVER REPORTING IN INVESTIGATIVE JOURNALISM, DO PAY DIRECTLY FROM ANYWHERE IN THE WORLD TO: NIGERIA BANK NAME-MONIEPOINT *BANK ACCOUNT NUMBER: 7076577445

Feel free to send us an email: letters@nigeriastandardnewspaper.com or call us directly at +2347076577445 (Nigeria) or WhatsApp American Roaming Mobile Number: +16825834890 (Chat messages only available)

donation